We don’t want you to be uniformed with the current market, unsure of where to go to find this information or who to trust for up-to-date data… so the Hunt Team will be releasing monthly reports on the Texas markets, which you can find on this site.

This post will be discussing the prior month’s report (February 2018):

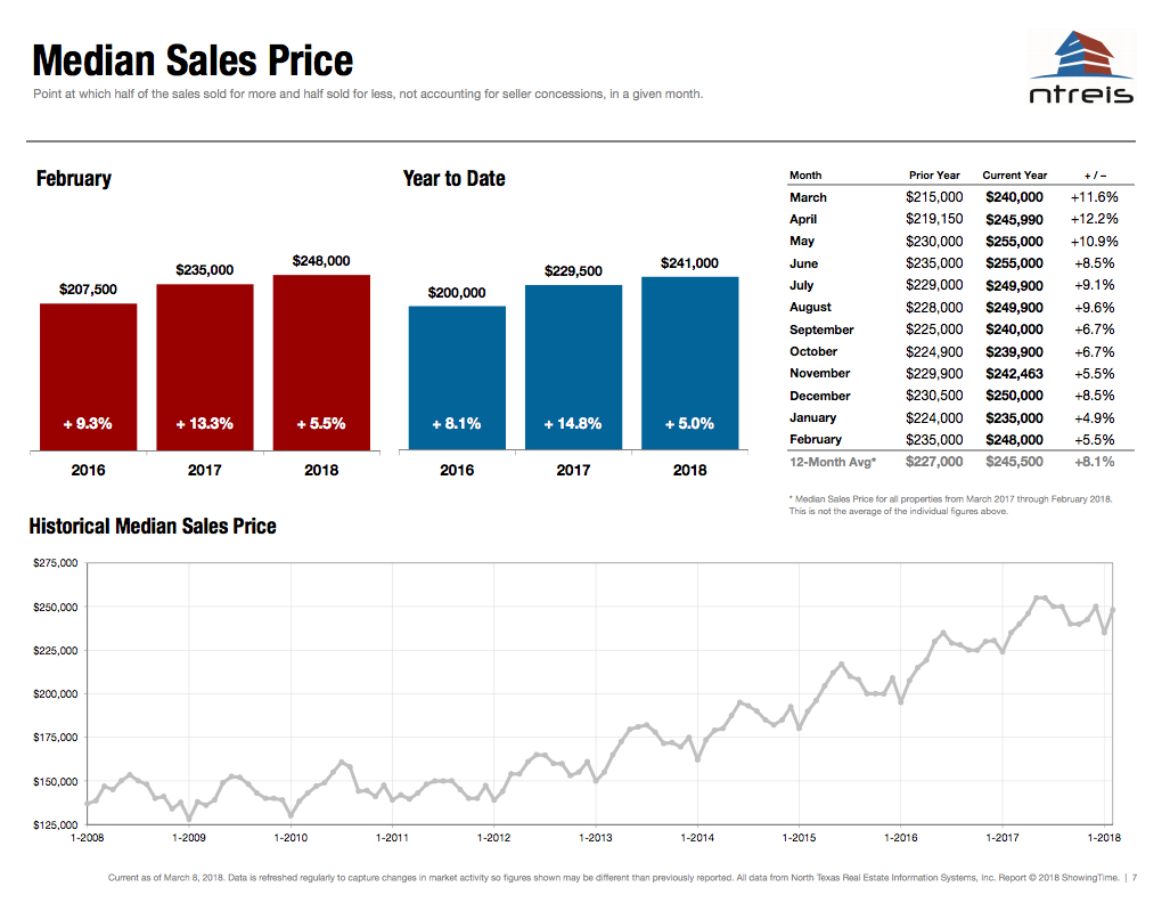

The three most prominent national market trends for residential real estate are the ongoing lack of abundant inventory, the steadily upward movement of home prices and year-over-year declines in home sales. Sales declines are a natural result of there being fewer homes for sale, but higher prices often indicate higher demand leading to competitive bidding. Markets are poised for increased supply, so there is hope that more sellers will take advantage of what appears to be a ready and willing buyer base.

In February, prevailing mortgage rates continued to rise. This has a notable impact on housing affordability and can leave consumers choosing between higher payments or lower-priced homes. According to the Mortgage Bankers Association, the average rate for 30-year fixed-rate mortgages with a 20 percent down payment that qualify for backing by Fannie Mae and Freddie Mac rose to its highest level since January 2014. A 4.5 or 4.6 percent rate might not seem high to those with extensive real estate experience, but it is newly high for many potential first-time home buyers. Upward rate pressure is likely to continue as long as the economy fares well.

Click here to see the complete report on the Market Activity for the North Texas Region.

Comments (0)